GRADE supporting change in the Global Tax Architecture

![]()

Ministers, economists urge honesty about benefits of UN tax convention for Europe

Ministers, economists, and NGOs speaking at a research conference in Paris today are calling on EU member states to be honest with their people about how a UN tax convention would drastically improve their lives. Speakers at the two-day conference described UN negotiations currently underway to establish a tax convention as the EU’s best shot to avoid losing over €1 trillion in public money to tax havens over the next 10 years, and urged EU states to halt their attempts to sabotage the process.

OECD tax reforms risk violating human rights law, UN experts warn in special intervention

A group of top-level UN experts with special mandates to investigate human rights violations have issued a formal communication to the OECD demanding answers for its failure to abide by human rights standards in its leadership of international tax policy. In their communication, the mandate holders warn that the OECD’s controversial “two-pillar” reforms, if implemented, could significantly reduce the amount of tax Global South countries can collect from multinational corporations and “could have a discriminatory impact on the grounds of gender, ethnicity and race.”

Tax abuse costs Malawi $51 million every year

Rachel Etter-Phoya quotes recent GRADE research saying the impact of tax abuse on the nation is quite huge, it could see 5000 additional children in school each year if it had the equivalent revenue lost through tax abuse

Tax abuse costs Malawi $51 million every year

Rachel Etter-Phoya quotes recent GRADE research saying the impact of tax abuse on the nation is quite huge, it could see 5000 additional children in school each year if it had the equivalent revenue lost through tax abuse

“Taxes saves lives”, coverage of research in Norwegian national newspaper

A case study from March of the telecoms company Vodafone in Africa shows how big the consequences of corporate tax from just one company can be. The study estimates that in the period 2007-2017, taxes from Vodafone have led to clean water for almost one million people, that one million people have their basic sanitary needs met, and that 800,000 children have received an extra year of schooling.

Breaking out of the bubble to transform education financing

Tax abuses, debt service and austerity reduce the resources available for education.

The impact of tax avoidance on people’s lives

One of our team Rachel Etter-Phoya discusses the impact on people’s lives of tax avoidance on the continent of Africa on BBC Sounds Focus on Africa.

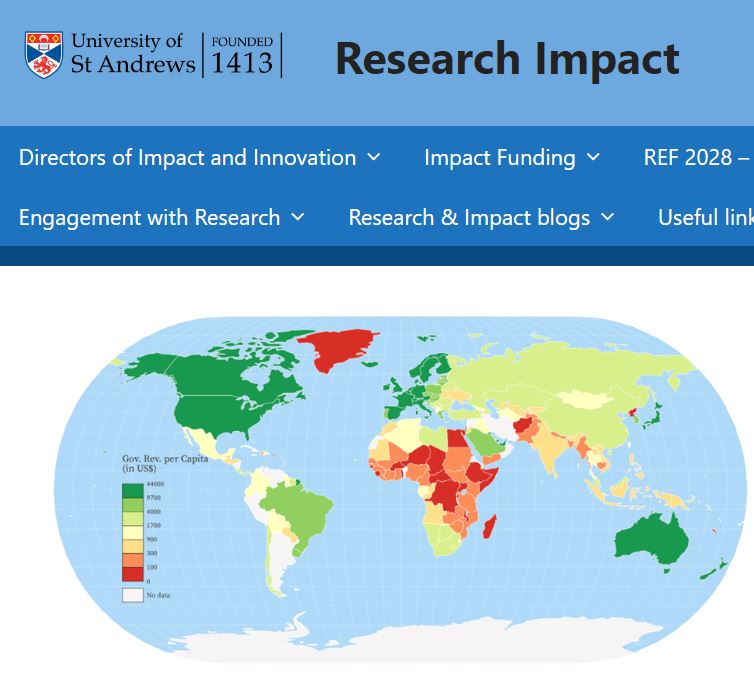

GRADE-ing tax policy for sustainable development in Sub-Saharan Africa

A blog which provides an overview of the GRADE project. “How do we support sustainable development? There are countless answers to this question, with 17 intersecting Sustainable Development Goals (SDGs) presenting numerous opportunities for social, environmental, and economic well-being. An important starting point may lie in the relationship between international policy and national governance – for instance, if a global policy can be made more equitable, it can improve the ability of countries everywhere to meet sustainability goals.”

Taxes, a matter of life or death

Blog discussing the paper How can corporate taxes contribute to sub-Saharan Africa’s Sustainable Development Goals (SDGs)? A case study of Vodafone. Discusses the importance of public country by country reporting

Foster Human Rights by Eradicating Multinational Tax Avoidance

Based on Vodafone’s data—and aiming to measure the positive human rights impact of corporate taxes paid rather than avoided—researchers at Scotland’s Universities of St. Andrews and Leicester and the African Centre for Tax and Economic Studies recently examined the potential for good when huge multinationals actually pay their taxes. (The researchers didn’t examine whether Vodafone is or isn’t an avoider today.)

Paying Tax Saves Lives

A podcast discussing the importance of taxpayers to human rights. “It’s horrific that there are so many people across the world who still don’t have access to ‘survival rights.’ Things like basic sanitation, clean water, quality education, decent healthcare so that mothers can survive childbirth – and so their children can even survive their childhood! This is where tax justice gets the most urgent, because tax literally saves lives. In this Taxcast edition, host Naomi Fowler talks to people who’ve looked at new data that demonstrates this. We wish every CEO, every company board member, every shareholder and every government minister in the world would read this report. Then look us in the eye and tell us why they’re not moving every muscle in their body to do what is in their power to protect people, mothers and children. Because when they don’t, they do have blood on their hands.”

Tax Justice Network letter to King Charles III – Full Text

At the Tax Justice Network, we believe our tax and financial systems are our most powerful tools for creating a just society that gives equal weight to the needs of everyone. As we celebrate our twentieth anniversary this year, we note the change of era reflected by Your Majesty’s coronation. We hope this can mark a pivotal moment to address the heavy financial and human costs borne by ordinary people in the UK, the Commonwealth, and around the world, due to the UK and its network of tax havens over which Your Majesty is Sovereign.

Will King Charles take the lead over action on tax havens?

The newly crowned monarch has been called on to help end ‘one of the world’s most enduring injustices’ – something that could be life-changing for millions.

King Charles urged to push for breakup of UK’s ‘network of satellite tax havens’

King Charles has been urged to call for the breakup of the “UK’s network of satellite tax havens” through which an estimated £152bn worth of tax is avoided every year, according to campaigners.

God Tax the King

While Britain’s overseas aid has dwindled in recent years, unwinding the web of tax havens instead would help many governments fulfill the rights of their citizens. If we were to reverse the tax revenue losses caused by the UK spider’s web, there would be 36 million more people with access to basic sanitation, 18 million more people with access to basic drinking water, and almost seven million children could attend school for an extra year, according to the Universities of St. Andrews and Leicester modeling tool GRADE.

A win for African leadership on international tax

Denied a seat at the table to decide tax rules, African countries moved the table to the UN.

How global tax dodging costs lives: new research shows a direct link to increased death rates

Tax abuse is an expensive business. According to a recent report by the Tax Justice Network, avoiding or evading tax deprives governments across the world of around US$427 billion (£302 billion) every year. This is money that could otherwise be spent on things like clean water, sanitation, education and health care.

It’s not cheap to save a life

A new research model shows that children and mothers are dying in poorer countries because of a lack of tax revenue. The authors say: tax havens accept the deadly consequences of their actions.

Government Revenue and Rights

To enjoy the benefits of improved public health, including reduced mortality, governments usually need to spend more across all the sectors that contribute to national healthcare.

UN calls on Netherlands to account for tax policy impact on child rights

The United Nations has issued a reminder that states, as duty bearers, have a responsibility to advance children’s rights. Activities such as profit shifting, offshoring wealth and hiding assets undermine public services.

Could post-Covid-19 finally be the era of fiscal and social justice in the world?

The coronavirus crisis has revealed the deplorable state of healthcare systems around the world, the struggle facing healthcare workers and the dismal conditions in which they have to work due to the lack of beds and protective equipment, but also the lack of medicines. How did we get there ?

International corporate tax avoidance and domestic government health expenditure

Half the world’s population does not have essential health services and many more do not have access to clean water, sanitation or education, all of which can contribute as much to health outcomes as health care. Many of the sustainable development goals (SDGs) address these issues and include targets for health coverage and determinants of health.